We are committed to the highest level of account and financial security for all our members.

This section of our website will help keep you informed of current fraudulent activities, tactics and alerts. We encourage you to use the information here as a resource to help protect yourself from becoming an unsuspecting victim of identity theft or other fraud or scam.

ServU Credit Union will never ask you to input your card number and PIN via phone, text message or in an email. As always,

contact us if you have any questions.

Don't let the criminals take your money!

Criminals are convincing everyday people to give up thousands and thousands of dollars of their hard earned money. Please don't turn away from this important message. You could save yourself or loved one from losing their life savings! This is not an exaggeration.

The latest scams are involving large wire transfers. This is your first red flag. Regardless of the reason you have ended up on the phone with someone you don't really know, if you are being asked to wire money, STOP!! Wire transfers are almost impossible to recover. Once you send that wire transfer the funds are gone. Even if you discovered that you are a victim of fraud within a few hours of sending the wire transfer, it is highly unlikely you will be able to recover the funds. Get help from the credit union or a trusted family member. DON'T send that wire transfer.

If you end up on the phone with someone you don't really know and they tell you not to tell anyone about your situation STOP!! The latest scams are convincing people that it is risky to tell the credit union or even their family members about what is going on with the situation they are in. This is your next red flag. The scammer will go out of their way to make friends with you. They are VERY good at this. They will make you think they can be trusted more than even your own family and friends. If this happens to you don't fall for it. They want to keep you from getting real help so they can steal your money.

If you suddenly get a message on your computer that says you need to call this number right away because your computer has been compromised, STOP!! You are calling the bad guys. But when you speak with them they will convince you they are the good guys. They might say they are from Microsoft. STOP!! Microsoft will NEVER put up a message on your computer like this. They just don't do this. In fact, NO reputable company out there operates like this. This is another huge red flag. Your computer is infected and you need assistance from someone you can really trust.

If you are being instructed how to get around security procedures meant to protect you, STOP!! The credit union uses important questionnaires for certain sensitive transactions such as wire transfers. They may seem annoying but we do this for only one reason – to protect you. If you have been coached on how to answer these questions or even told to flat out lie, STOP!! The criminals are so evil they will convince you to get around all security procedures. If you do this, in the end your money will be gone and so will the bad guys. And in some cases, you could even make yourself an accessory to a crime by being dishonest on the questionnaire. So STOP!! Help us protect you from huge losses by always being truthful on questionnaires.

Above are several red flags of the recent scams going across the country. This is very real and is affecting people right in our area. If you are seeing any of these red flags just STOP!! Call the credit union for help or speak to a REAL trusted family member. This is who will really help you. Don't allow yourself to be a victim by giving away your hard earned money to the crooks. Just take a minute and STOP!!

Previous Security Alerts

Debit and Credit Card Breaches: What You Need to Know

Debit and Credit Card Breaches: What You Need to Know

Debit and Credit Card Breaches: What You Need to Know

If a merchant or retailer has had their debit or card data breached, we are notified of the possible compromise of all ServU members who used their card at that merchant or retailer. It does not necessarily mean your card information has been compromised but we are proactive and always reissue new cards to protect your financial identity. If your debit or credit card data is breached at a retailer, the cost of card replacement or account reimbursement to you is typically paid not by the merchant where the breach occurred, but by your credit union.

Reviewing and monitoring of your transactions is important to early detection of possible fraud. To make this possible, ServU Credit Union offers free 24 hour online banking and telephone teller services.

ServU Credit Union will never ask you to input your card number and PIN via phone, text message or in an email. If you are contacted asking for any personal or account information, do not give it out.

Your financial safety is important to us and we will do everything we can to ensure that action is taken to help you avoid becoming a victim of identity or account theft. You can always feel free to reach our card service department at 607-936-2293.

Read more about the campaign to help "Stop the Data Breaches"

Debit Card Fraud and Spoofing Call Scams

Debit Card Fraud and Spoofing Call Scams

We have been alerted of a scam effecting other credit unions in New York State. Members are receiving spoofing calls (calls that look like they are coming from the credit union phone number) asking members to verify recent transactions. Some of the transactions are legitimate and others were not. When the member stated some of the transactions were not theirs, the scammer informed the member that a new card was needed and it would be mailed to the member by FedEx. The scammer even provided a confirmation number. The member was asked to create a new PIN over the phone, and to change the online banking password while on the phone. The scammer told the member to ignore any fraud alert emails from the credit union because they had already talked to the fraud department. THIS IS A SCAM.

Remember - ServU Credit Union will never ask you for personal information like your PIN or Online Banking password over the phone. If you suspect a scam, hang up and call us directly to verify that it was really a ServU staff member that called.

Data breach at Home Depot

Data breach at Home Depot

Home Depot has confirmed a nationwide credit and debit card data breach for the time period of April 11 – September 7, 2014. We have been notified of cards that may have been compromised in this breach. Your credit union has been proactive by limiting the dollar amount of daily transactions for the cards believed compromised. The credit union is reissuing new cards for members who may have been compromised.

ServU Credit Union has a 24/7 fraud monitoring system for both debit and credit cards. This system looks for any suspicious activity outside your normal spending patterns. Please review your accounts often and contact us immediately if you notice anything out of the ordinary (607-936-2293 or 1-800-443-0663). If you believe you used your ServU debit or credit card during the breach period, please contact us to confirm If your card has been affected.

Monitoring your debit card activity may be done with online banking, mobile banking, telephone teller system and calling or stopping into the credit union during business hours. Credit cardholders can review activity anytime by signing on to ezcardinfo.com.

For blocking cards after business hours, use the following numbers: Debit cards 800-682-6075 - Credit cards 800-991-4961

Survey scam

Survey scam

A few ServU Credit Union members have reported having a pop-up window come up when going to the credit union website, directing them to an anonymous survey. The message promises a free gift when the survey is completed. THIS IS NOT A VALID SURVEY. DO NOT COMPLETE THIS.

If this pop-up survey came up for you it is likely that your computer is infected with malware. Malware is software intended to harm the user; in this case by tricking you into giving out private information. If you have completed this survey please contact the credit union for assistance in protecting your account information.

All online banking users should protect themselves by having up to date anti-virus software installed on any device they use to access their accounts. Even with anti-virus software installed you must be cautious. When using online banking screens you should be suspicious of any screens that you have not previously seen.

If you have any doubt about the screen you are looking at contact the credit union by phone (607-936-2293 or 1-800-443-0663) or in person for further assistance.

Phishing Scheme

Phishing Scheme

Some members are receiving phone calls where the caller is claiming that their credit or debit card is being fraudulently used in another state and needs to be blocked. In an effort to convince you that the call is legitimate, the caller supplies the first four digits and the last four digits of your card number. The caller tells you that all you have to do is supply the middle digits of your card number to confirm your identity.

DO NOT DO THIS. This is yet another scam to get your card numbers.

Legitimate calls from a financial institution will never ask you to supply any part of your card number. Legitimate callers from ServU’s fraud protection services already know your card information. They have no need to ever ask you for your card numbers.

People have received automated phone calls stating that their ATM/DEBIT card has been blocked

People have received automated phone calls stating that their ATM/DEBIT card has been blocked

The call asks you to press 1 to reactivate your card and input your sixteen digit card number and your PIN. Some have received text messages via cell phone from

[email protected] with the message: "

ServU CU Please contact 818-534-5383."

DO NOT DO THIS. This is a scam to get your card numbers.

If you did receive this call or text message and gave your card number, contact us immediately so we can protect your account. During regular business hours Monday thru Friday (9am-5pm) please call ServU FCU at 607-936-2293. After hours please call 1-800-682-6075 to block your card.

NOTE: Any call that asks you to input your card number and PIN is not a legitimate call.

ServU Credit Union will never ask you to input your card number and PIN via phone, text message or in an email.  Fraudulent emails are being received that appear to be sent from the Federal Reserve

Fraudulent emails are being received that appear to be sent from the Federal Reserve

Specifically, the email claims to be from the Federal Reserve Wire Network and appears to be sent from “

[email protected].”

This is a sample of what the email might look like.

= = = = = Sample Email = = = = = =

From:

[email protected][mailto:

[email protected] ]

Sent: Wednesday, March 02, 2011 10:09 AM

To: Doe, John

Subject: Your Wire fund transfer

The Wire transaction , recently sent from your checking account (by you or any other person), was cancelled by the Federal Reserve Wire Network.

Please click here to view details

------------------------------------------------------------------

Adam Diaz ,

Fraud Department

= = = = = = = = = = = = = = = = = = =

This is a fraudulent email. It was not sent by the Federal Reserve. Do NOT click on any of the links.

Be aware that phishing emails frequently have attachments and/or links to Web pages that host malicious code and software. Do not open attachments or follow Web links in unsolicited emails from unknown parties or from parties with whom you do not normally communicate, or that appear to be known but are suspicious or otherwise unusual.

A current scam being circulated comes in the form of a phishing email related to Verified by Visa

A current scam being circulated comes in the form of a phishing email related to Verified by Visa

Users are sent an email alerting them that their credit card has been suspended. The scammers are trying to make the email look even more authentic by providing a fake case number. Clicking on the link in the email takes the email recipient to a fake website. Once on the bogus website, users are requested to provide all the information they gave to the bank that issued the Visa card in the first place.

Real Verified by Visa invitations, or any legitimate email from a bank or financial institution for that matter, will never ask customers to repeat bank account information, passwords, social security or National Insurance numbers, or other such personal information. Once fraudsters have this information, it is very easy for them to commit identity theft.

Don't be a Victim of the Verified by Visa scam! If in doubt about the legitimacy of an email or communication purporting to be from Verified by Visa, confirm the communication via legitimate channels. Type in the website url into the address bar in a browser or phone the number printed on publications you've received from the credit union.

Furthermore, if the legitimacy of an email is doubtful, do not click on the link. The url may even seem genuine - scammers often register website domains that are similar to the domain of the legitimate company.

In general, it's worthwhile to be vigilant when receiving emails that seem to be from any service provider that requires too many personal details. Always check it out via another, trustworthy medium before giving up any personal information.

Phishing Alert - Email claiming to be from the NACHA

Phishing Alert - Email claiming to be from the NACHA

The Electronic Payments Association has received reports that individuals and/or companies have received a fraudulent e-mail that has the appearance of having been sent from NACHA. See sample below.

The subject line of the e-mail states: “Unauthorized ACH Transaction.” The e-mail includes a link that redirects the individual to a fake Web page and contains a link which is almost certainly an executable virus with malware. Do not click on the link. Both the e-mail and the related website are fraudulent.

Be aware that phishing e-mails frequently have links to Web pages that host malicious code and software. Do not follow Web links in unsolicited e-mails from unknown parties or from parties with whom you do not normally communicate, or that appear to be known but are suspicious or otherwise unusual.

NACHA itself does not process nor touch the ACH transactions that flow to and from organizations and financial institutions. NACHA does not send communications to individuals or organizations about individual ACH transactions that they originate or receive.

If malicious code is detected or suspected on a computer, consult with a computer security or anti-virus specialist to remove malicious code or re-install a clean image of the computer system. Always use anti-virus software and ensure that the virus signatures are automatically updated.

Ensure that the computer operating systems and common software applications security patches are installed and current.

Be alert for different variations of fraudulent e-mails.

= = = = = Sample E-mail = = = = = =

From: Information

Sent: Thursday, July 22, 2010 8:27 AM

To: Doe, John Subject: Unauthorized ACH Transaction

Dear bank account holder,

The ACH transaction, recently initiated from your bank account, was rejected by the Electronic Payments Association. Please review the transaction report by clicking the link below:

Unauthorized ACH Transaction Report

------------------------------------------------------------------

Copyright ©2009 by NACHA - The Electronic Payments Association

Virus/Trojan that could hit your home computer

Virus/Trojan that could hit your home computer

Make sure the virus protection on your home/office computers is up to date. Viruses are targeting personal home computers. These viruses can be downloaded to your computer without your knowledge. The ability to download “free” items (including, but not limited to software) from the Internet and the overwhelming popularity and ease of use of social networking sites help make it possible for viruses to be installed on your home or office computers, usually without your knowledge.

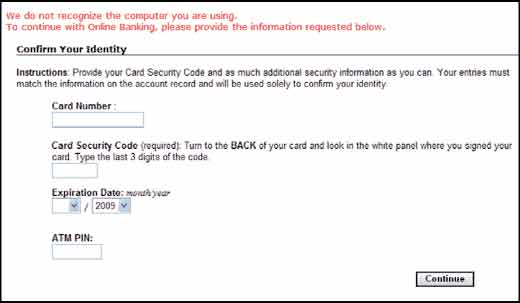

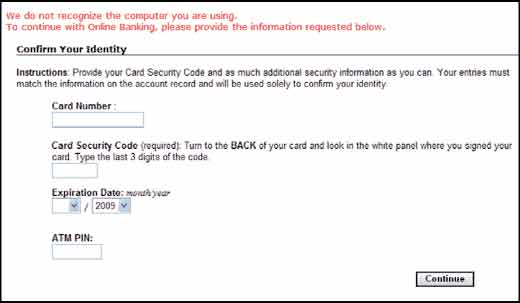

One type of virus/trojan being found on home computers creates a web page that appears to be part of your financial institution’s website. The Web page will look very plain and generic and will most likely not have the institution’s name or logo.

What you could see if your computer has this type of virus:

The page may be similar to the following:

Note that the page is looking for you to enter information such as your ATM pin number, card number and security code. If you see a Web page similar to the one above, follow these procedures:

1. Notify us immediately if you submitted the information that the page requested. (Remember we will never ask you to confirm your identity with credit card numbers, security codes and expiration dates.)

2. If this page (or a similar one) appears on your home or office computer it could mean that you have a virus installed and you will need to have it removed.

As always, we are trying to protect our members from the many phishing schemes fraudsters are using to gain your account information.

NCUA Reports Fraud Email Phishing Activity

NCUA Reports Fraud Email Phishing Activity

Beware of fraudulent emails claiming to be from NCUA, offering payment for a survey.

The National Credit Union Administration (NCUA) is reporting recently simulated NCUA email boxes. The fraudulent emails solicit credit union member participation in an Online Survey or Member Survey, and promise compensation of $40 as an inducement to respond to the email. The emails are fraudulent, and may be an attempt to obtain confidential member information.

NCUA does not solicit such information from credit union members. This is a phishing activity with no NCUA activity or approval. If you have received these emails please do not respond. If you have any questions or concerns please email NCUA at

[email protected] .

Debit and Credit Card Breaches: What You Need to Know

Debit and Credit Card Breaches: What You Need to Know  Debit Card Fraud and Spoofing Call Scams

Debit Card Fraud and Spoofing Call Scams  Data breach at Home Depot

Data breach at Home Depot  Survey scam

Survey scam  Phishing Scheme

Phishing Scheme  People have received automated phone calls stating that their ATM/DEBIT card has been blocked

People have received automated phone calls stating that their ATM/DEBIT card has been blocked  Fraudulent emails are being received that appear to be sent from the Federal Reserve

Fraudulent emails are being received that appear to be sent from the Federal Reserve  A current scam being circulated comes in the form of a phishing email related to Verified by Visa

A current scam being circulated comes in the form of a phishing email related to Verified by Visa  Phishing Alert - Email claiming to be from the NACHA

Phishing Alert - Email claiming to be from the NACHA  Virus/Trojan that could hit your home computer

Virus/Trojan that could hit your home computer  NCUA Reports Fraud Email Phishing Activity

NCUA Reports Fraud Email Phishing Activity